As I was completing my research for an upcoming blog on LTE Carrier Aggregation, I found that my previous LTE Band Class reference sheet was missing some of the more recent Band Class updates, so I decided to share my new reference document with a few comments.

FDD Band Classes:

The first notable band class addition in Band 30. This band class creates a definition for FDD operation in the WCS (2.3GHz) band which was previously defined only for TDD operation.

From the Spectrum Grid view of the Spectrum Ownership and Analysis Tool, you can see that Band 30 does not include the 5MHz channels that AT&T purchased to essentially become guard bands for the Satellite Audio guys. This will provide AT&T with a 10x10 LTE channel on a market by market basis, as they resolve the remaining ownership issues in the WCS band.

The next two band classes are not new, but I previously skipped over these band classes because I didn't fully understand their frequency breaks.

Band 26

Previously I thought this was a specific band for Sprint IDEN operation that is adjacent to the cellular band. This is the band where Sprint is placing their 2nd LTE channel (5 MHz) and a CDMA channel (1.23 MHz). Looking at the frequencies in detail, the band class covers the IDEN spectrum and the adjacent cellular spectrum.

This is similar to Sprint's Band 25 which includes all of the PCS band plus their G block spectrum (but not the H block).

So you would think that all of the North American carriers could standardize to Band 25 for PCS operation and Band 26 for Cellular. Using the latest iPhone 5s LTE band support,

you can see the Verizon, T-Mobile, and AT&T iPhone's support Band 2 and 25 for PCS, but only the cellular band (Band 5). Sprint iPhone 5s includes,

both Band 2 and 25 for PCS and Band 5 and 26 for cellular.

Band 10:

This is referenced as the AWS extended band and you can note from above that it is not currently applied to smartphones like the iPhone 5s. This band class seems to be a preparation for the future use of the AWS-2 and AWS-3 spectrum and the government shared use band that are both adjacent to the existing AWS spectrum band. Here is how the downlink looks in the Spectrum Ownership Analysis Tool:

Note that Band 10 does not cover the entire band contemplated for AWS-3, nor does it include Dish's Band 23. For the uplink:

This again depicts that Band 10 is not currently set to include the entire shared government opportunity.

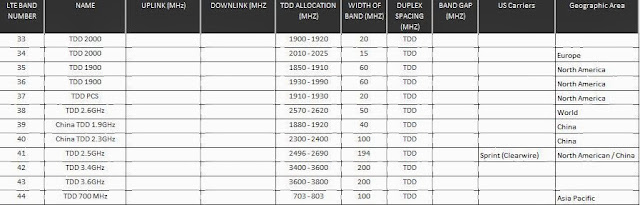

TDD Band Classes:

Here is the reference sheet the TDD band classes.

On this reference sheet I hadn't looked closely at band classes 35, 36, and 37. I had always focused on the 2.3GHz and 2.5GHz as the only bands that were designated for TDD support in North America. These three band classes create 140MHz block of spectrum that could be for TDD deployment. Here is how these bands appear in the Spectrum Ownership Analysis Tool:

I'm not sure what the history is on these band classes, but they would support TDD operation in both the PCS uplink and downlink bands as well as in the 20 MHz between the bands. Since the PCS frequencies are highly deployed, I would consider it very unlikely to see TDD systems in this band in the near future, and I doubt that the PCS band is authorized for TDD operation. It will be interesting to see whether any of the wireless carriers begin to look this direction. With Sprint stepping out of the H block auction, they seem to be signalling that TDD operation is more important to them and the Band 37 block (including Sprint's G block) could be the reason why Dish is pushing forward in the H block auction. Please comment if you are aware why the 3GPP has included these 3 TDD band classes.